Pmax Insights Over Time

Pmax Insights Over Time

Right now (Q4 2023/Q1 2024) everyone is talking about the Mike Rhodes Pmax Summary script. You copy and paste some code into your Google Ads account, copy the sheet provided in his LinkedIn post and click “Run” and BOOM more data than Google has ever given you about your Pmax campaigns. Splitting out Shopping, Display, Video and everything else that’s left over – which equates to Text Ads, Native and whatever else Google can’t decide to create separate assets for.

We stumbled onto it on LinkedIn like most people and were obviously interested to try it and also sceptical as to what it is Mike Rhodes is getting out of it. After reviewing the code, we were happy that it was safe. We’re not saying that it would be anything other than safe, it’s just good to check code you get from the internet. So, Mike’s motive for releasing it for free is really to improve his profile and reach, which is actually a very cool strategy to adopt. We kind of wish we had thought of it first. We do have a few bug-bears though, particularly if you have a bigger account. The look back time frame is limited, particularly in some cases due to the size of the data you’re pulling – Google Scripts have limits on how many calls/processes they can make and how long they can run for – and it doesn’t quite nail down what we wanted. Which was to analyse how Pmax serves over different surfaces due to the decisions we’ve made and the trends it has witnessed in the past year.

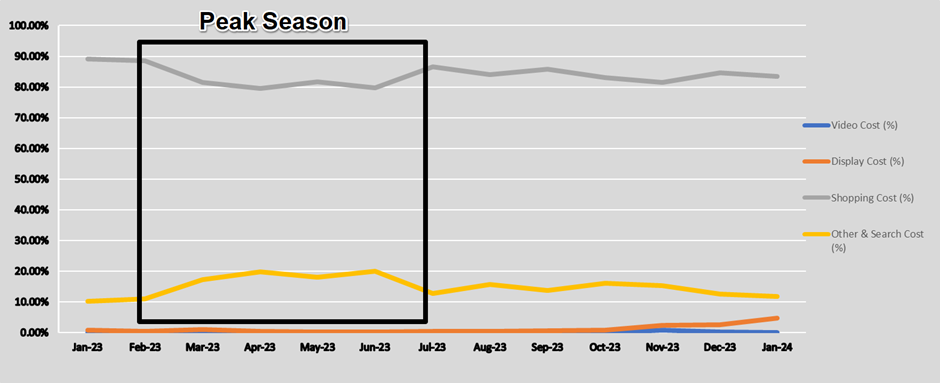

But this gave us an idea. So, we started writing our own scripts to do exactly what we wanted, and it’s been quite interesting. For a particularly large seasonal Ecommerce client we ran it against all of their Pmax data and got some interesting charts:

In the peak season we see Other & Search ads pickup quite a bit. In fact getting to about 20% of total spend for the Pmax campaigns as a whole. No doubt Pmax volumes have increased on Search and there’s an excess of inventory available.

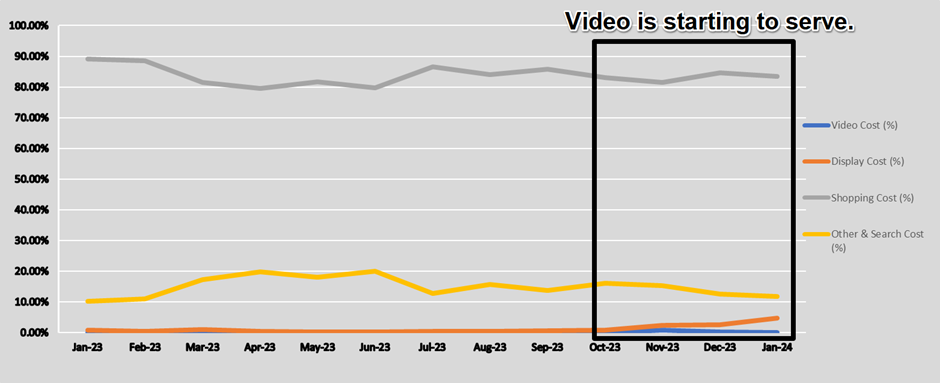

But it’s the most recent quarter and January 2024 that’s of more interest to us:

We’ve noticed that Video is starting to increase as a proportion of our Spend. We know that now is key prospecting season for this client’s industry, but we haven’t changed our video creative. They’re in the process of creating better quality and more appealing videos and se we’re surprised that Pmax is pushing these “old” videos. It gets even more interesting when we look at individual campaigns:

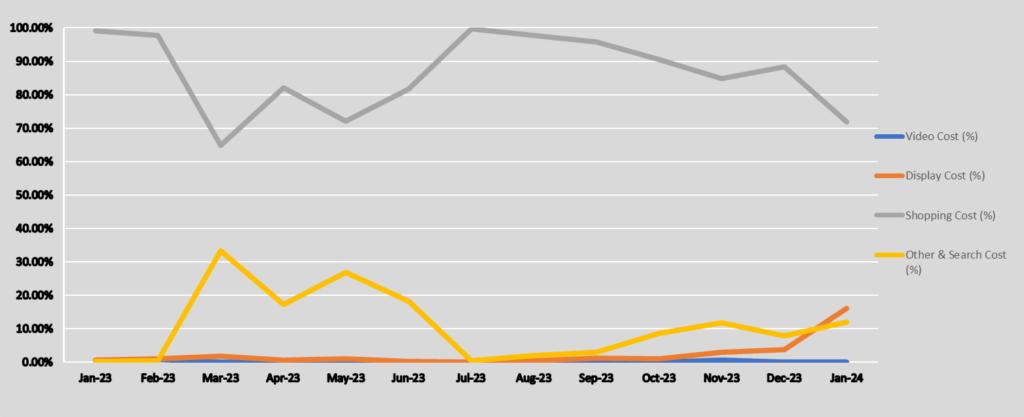

Here we can see that Pmax is spending a larger proportion of our budgets on Other & Search over the course of last year (this isn’t even our biggest campaign) and recently his picked up on the Video ads too.

A part of us would like to think that Pmax is so intelligent that it’s started prospecting in preparation for the season kicking off in March. Unfortunately, the sceptics in us think it’s more likely either Google has found new Video inventory, or prioritised Video in Pmax because of a whole in their budgets.

The question will always be: What do we do about it?

In this case we’re working with the client in making sure that the new Videos will be ready as soon as possible. But also, to review our Text assets to make sure they’re optimal for out-of-season traffic. Another thing to consider is whether a competitor has pulled their budget and maybe Text Ads and Video auctions are less competitive and have cheaper traffic for which Pmax can justify its budget allocation. All of these things need to be considered. But one thing is certain: 6 months ago we didn’t have this data. The industry owes Mike Rhodes a big thank you for opening our eyes and reminding us to consult the API, and not to forget to use your imagination for data!

Next, we’ll be focussing on the data anomalies that this is raising in Pmax accounts. Negative number of impressions? Oh yes, according to Google it’s possible.

If you would be interested in talking to use about doing the same analysis for your campaigns, feel free to get in touch.